Featured

- Get link

- X

- Other Apps

Epo Vs Hmo Plan

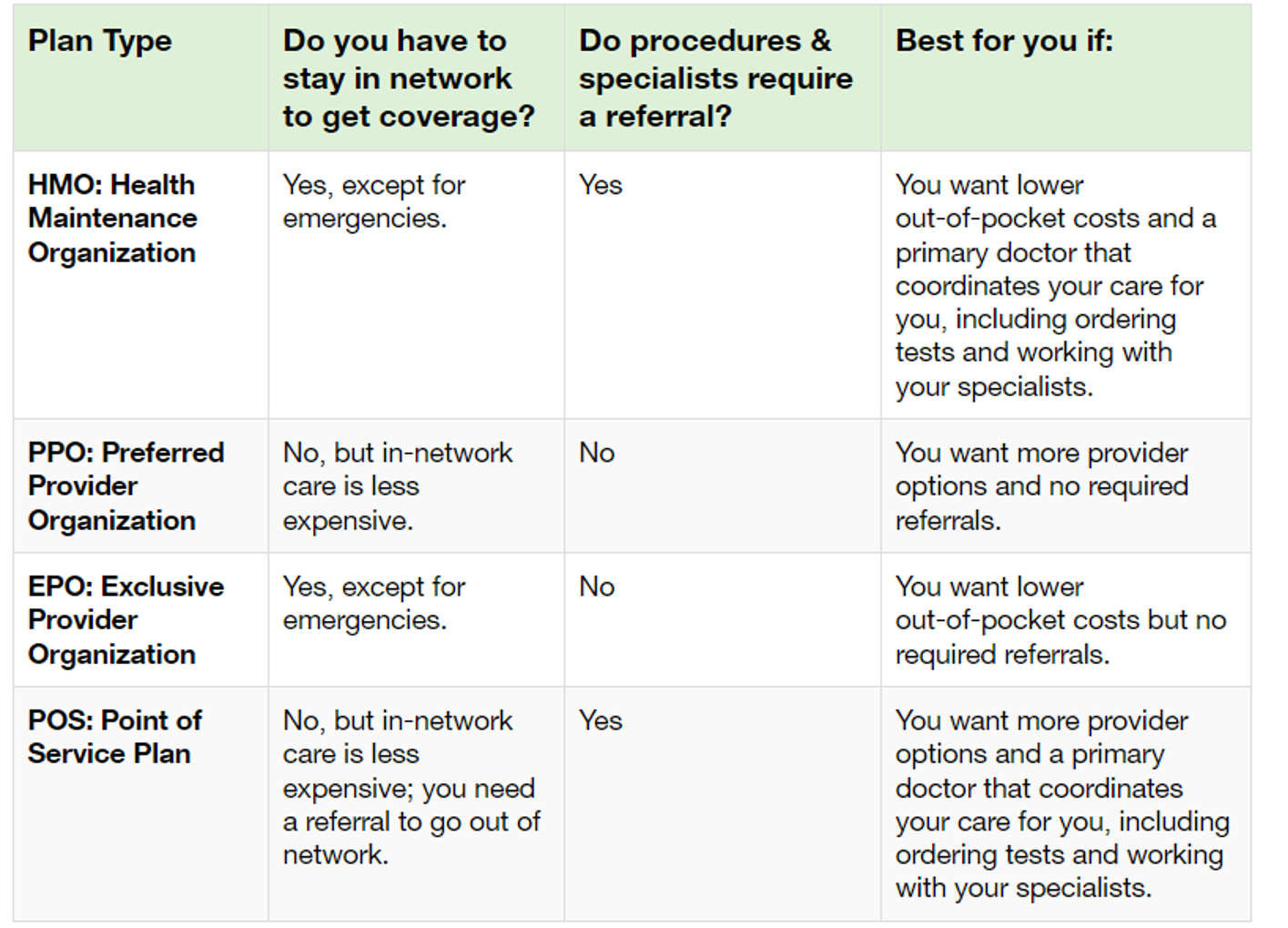

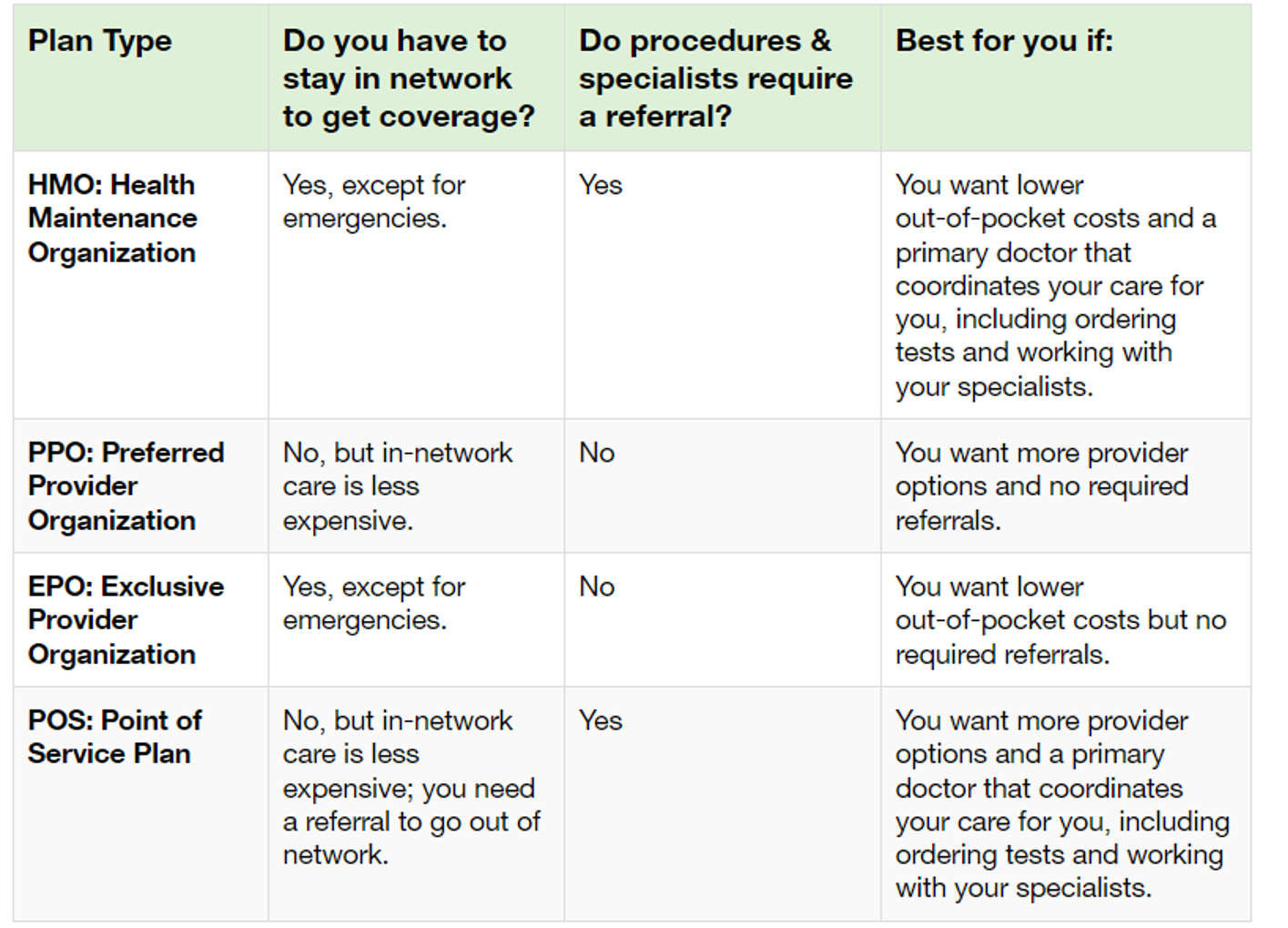

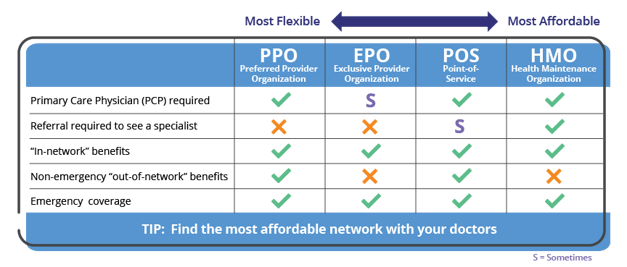

There are a number of different types of networks with HMO PPO EPO and POS being some of the most common. This may be an HMO PPO or EPO and is a classification for the type of network your plan offers.

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Of the three plan types HMO PPO and EPO you have HMO and PPO at two opposite ends of the spectrum with EPO plans somewhere in the middle.

Epo vs hmo plan. But an EPO plan is like an HMO plan in that youre responsible for paying all. If playback doesnt begin shortly try restarting your device. A provider network can be made up of doctors hospitals and other health care providers and facilities that have agreed to offer negotiated rates for services to insureds of certain medical insurance plans.

An EPO or exclusive provider organization is a bit like a hybrid of an HMO and a PPO. EPO plans differ from Health Maintenance Organizations HMOs by offering participants a greater amount of flexibility when selecting a healthcare provider. An EPO or exclusive provider organization is a bit like a hybrid of an HMO and a PPO.

This type of plan gives you a little more freedom than an HMO plan. Preferred provider organizations PPOs cover care provided both inside and outside the plans provider network. The Difference Between EPO HMO and PPO Plans.

Costs are kept low because providers charge a fee that has been negotiated with your EPO plan ahead of time. Then you can see where the EPO fits in as a hybrid of the other two. EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO.

A Health Maintenance Organization HMO plan is one of the cheapest types of health. An affordable plan with out-of-network coverage. HSA stands for health savings account and HSA-qualified plans can be HMOs PPOs EPOs or POS plans.

You pay less if you use providers that belong to the plans network. Some of these plans provide more flexibility in which providers you can while see while others might require you to get permission or pre-authorization from the insurance company before you can have a medical procedure. PPO preferred provider organization is a type of health plan that contracts with medical providers such as hospitals and doctors to create a network of participating providers.

You can self-refer to an in-network provider when a medical need arises. But like an HMO you are responsible for paying out-of-pocket if you seek care from a doctor outside your plans network. EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO.

HMOs often provide integrated care and focus on prevention and wellness. You should recognize the difference between HMO and PPO plans first. An HMO is a health maintenance organization a PPO is a preferred provider organization and an EPO is an exclusive provider organization.

Also question is what is the difference between EPO and HMO. EPO is short for Exclusive Provider Organization. PPO HMO EPO exclusive provider organization and POS point of service plans have different benefits and costs.

EPOs are similar to HMOs in that you must stay within your network emergency care is an exception however with an EPO you generally do not need to select a Primary Care Physician nor receive a referral to see a specialist. Videos you watch may be added to the TVs. Like a PPO you do not need a referral to get care from a specialist.

As with an HMO a Point of Service POS plan requires that you. HSA-qualified plans must meet specific plan design requirements laid out by the IRS but they are not restricted in terms of the type of managed care they use. For some however an HMO health maintenance organization or PPO preferred provider organization might be a better fit.

HMO POS PPO EPO and HDHP with HSA.

Individual And Family Health Plans Wilson Consulting Group

Individual And Family Health Plans Wilson Consulting Group

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

Know Your Options Individual Health Insurance In Tennessee

Know Your Options Individual Health Insurance In Tennessee

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Hmo Ppo Or Epo I Just Don T Know

Hmo Ppo Or Epo I Just Don T Know

What S The Difference Between Hmo Pos Epo And Ppo Plans E D Bellis

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

Ppo Epo Hmo Which Is The Best Safe Policies Insurance

Ppo Epo Hmo Which Is The Best Safe Policies Insurance

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Epo Health Insurance Plan What You Need To Know My Calchoice

Epo Health Insurance Plan What You Need To Know My Calchoice

Hmo Vs Ppo Which Plan Is Best For You

Hmo Vs Ppo Which Plan Is Best For You

Comments

Post a Comment