Featured

Insurance Companies In Southern California

California also offers Covered California a state-run health insurance exchange which aids residents with applying for health coverage. The Automobile Club of Southern California serves the following counties.

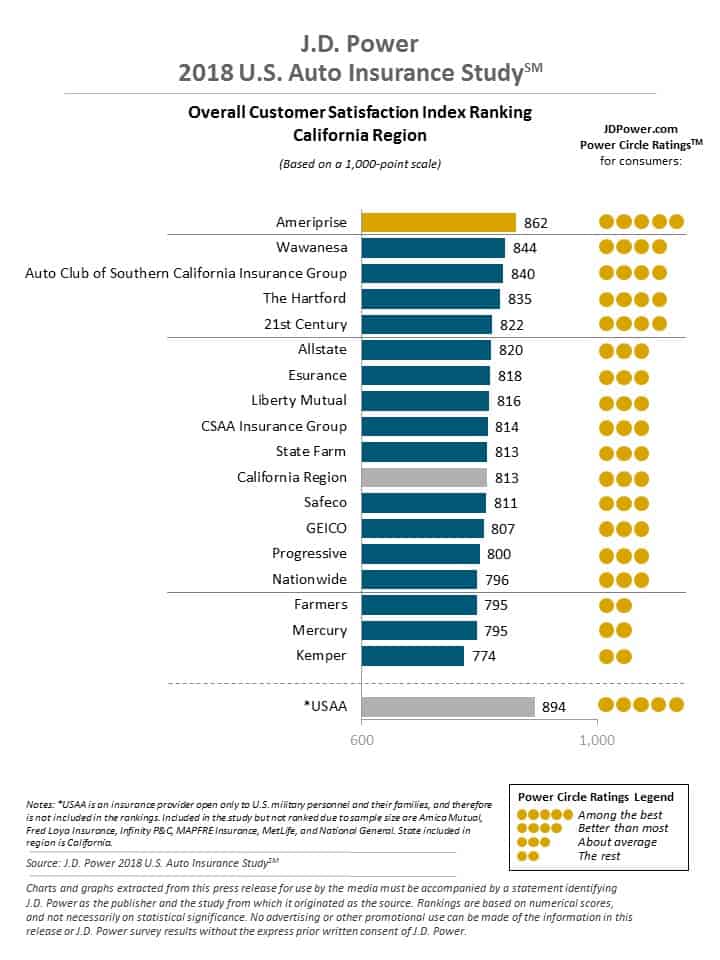

Best Car Insurance In California For 2021

Best Car Insurance In California For 2021

In 2018 NCQA rated more than 1000 health insurance plans based on clinical quality member satisfaction and NCQA Accreditation Survey results.

Insurance companies in southern california. 80 Zeilen Insurance Incorporated is an insurance company that has served the Southern. San Diego is one of the best places to live in the US. Average rates for 200K dwelling.

Kin Insurance is an insurtech startup founded in 2016 and headquartered in Chicago. 247 roadside assistance rental car reimbursement and even glass. Of those 10000 approximately 15 to 20 are greater than magnitude 40.

For year 2011 companys Justified Complaint Ratio was 16. Anthem Blue Cross of California. Cost of Auto Insurance in California.

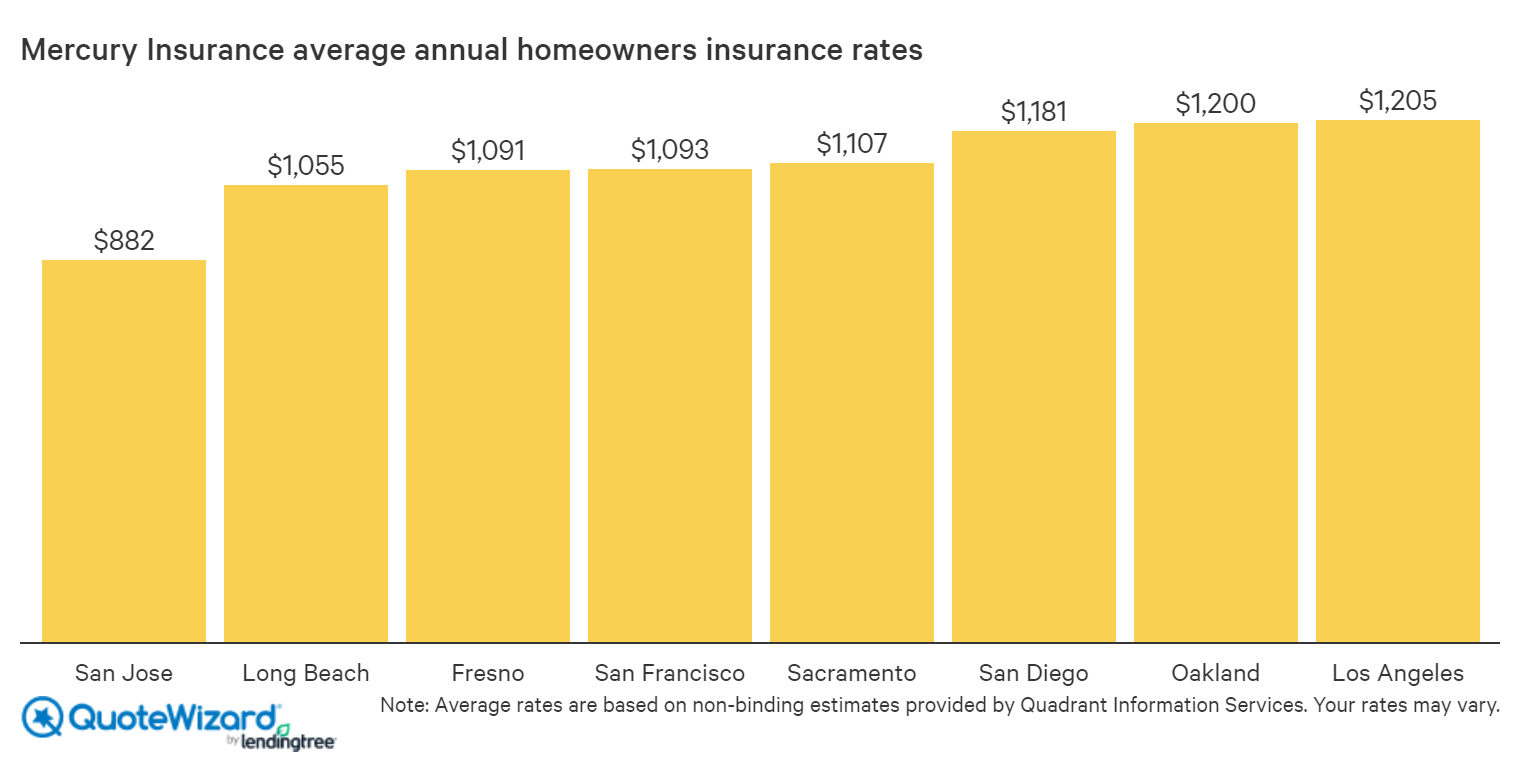

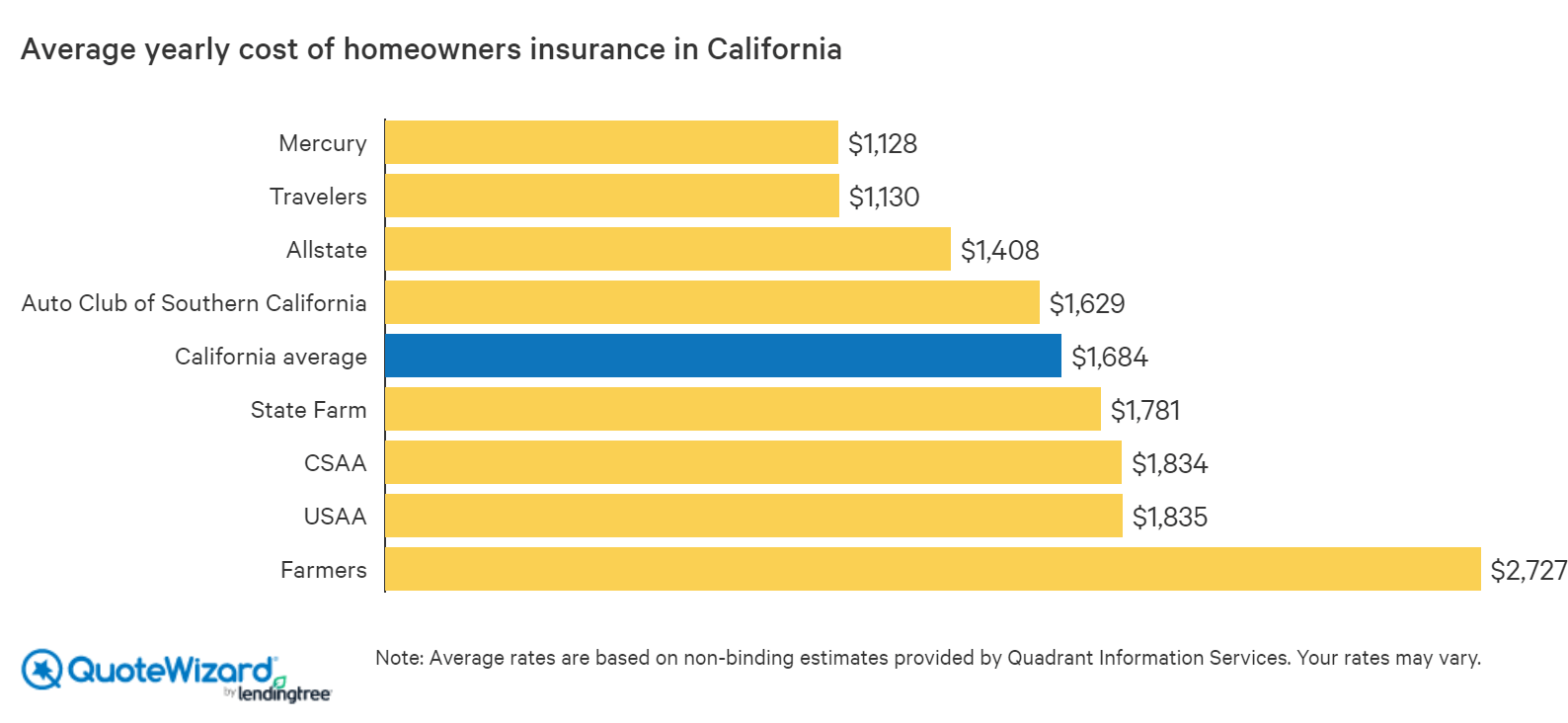

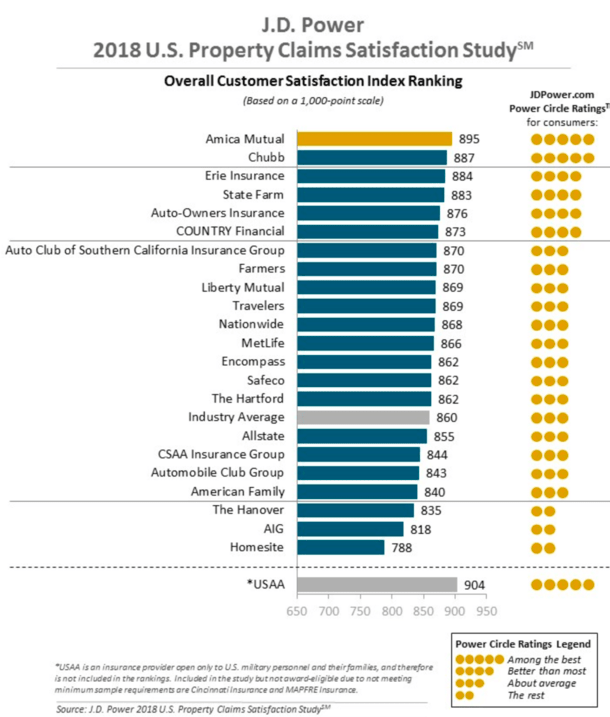

According to the United States Geological Survey there are about 10000 earthquakes in the southern California area. In the table below you can compare the average homeowners insurance rates for the six largest home insurance companies in California. The company also offers antique and classic car insurance coverage quotes through their agents.

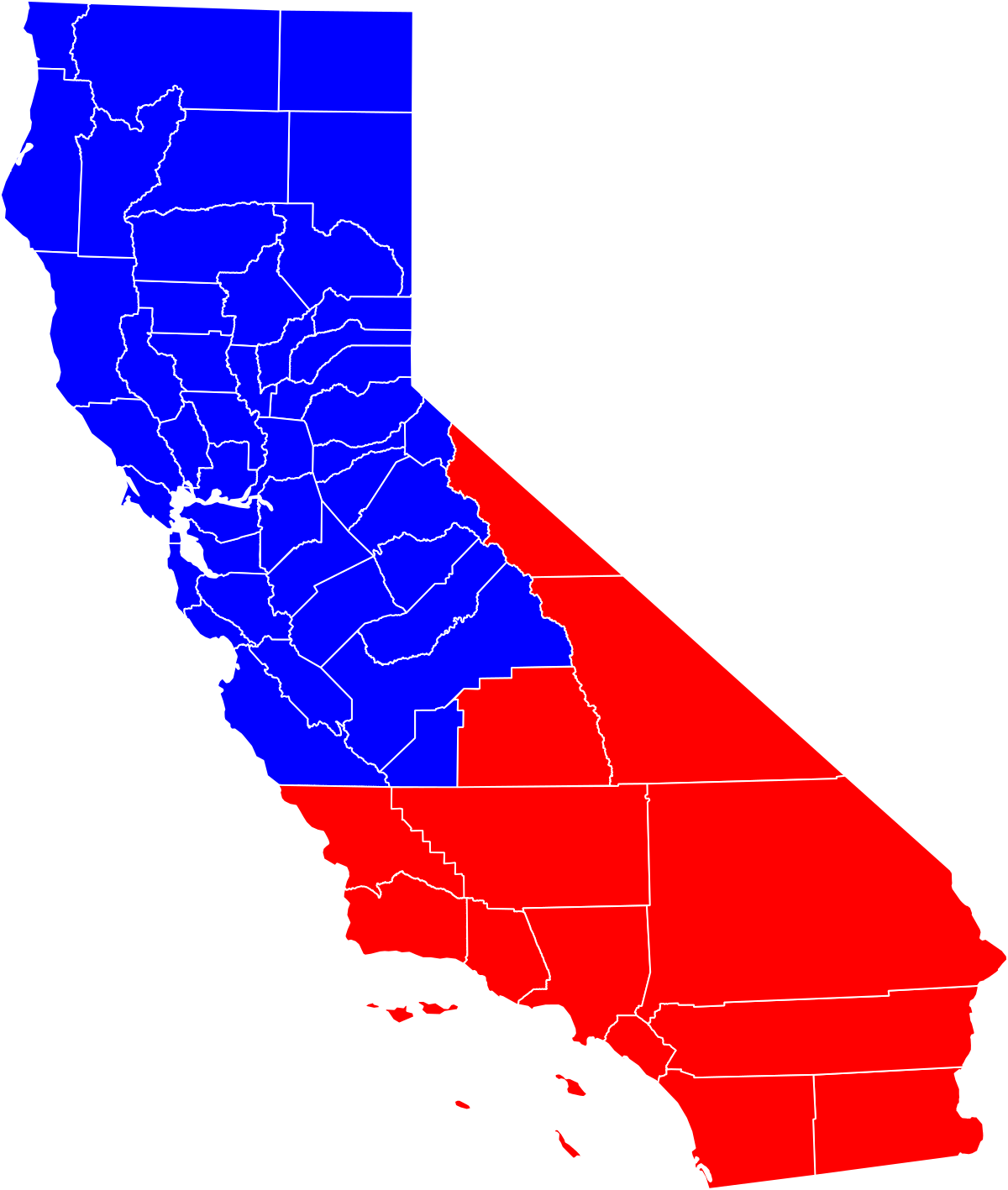

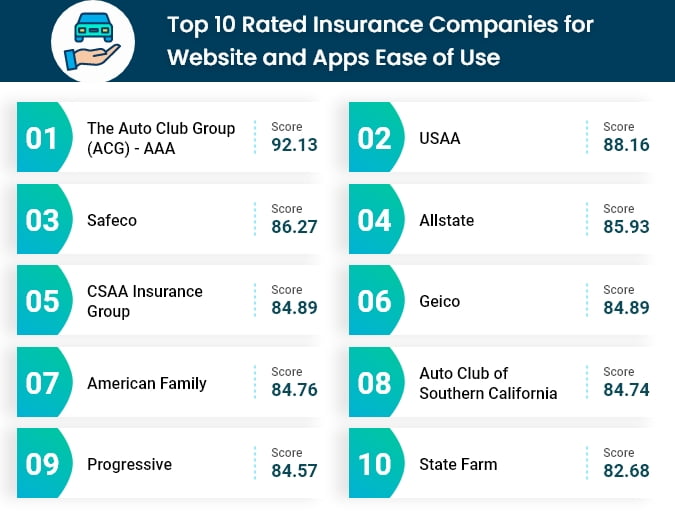

Interinsurance Exchange of the Automobile Club and AAA Northern are two companies that combine to service AAA members in the state of California. Founded in 1962 Mercury Insurance was started in California making this insurer uniquely familiar with the state its vast geography and the. The Burkholz Insurance Agency is the best insurance agency in southern California.

39 Zeilen Blue Shield of California Life and Health Insurance Company. Click a plan name for a detailed analysis. Our list includes big national names such as Allstate State Farm and USAA but also local player Mercury Insurance.

Its mission is to offer affordable cover to homeowners and reports that customers save an average of 500. Among the six companies analyzed Mercury offers the cheapest home insurance rates on average for a 200K California home. However if you live in California you can probably bank on California Capital and Mercury being two of your cheapest insurance providers in the state.

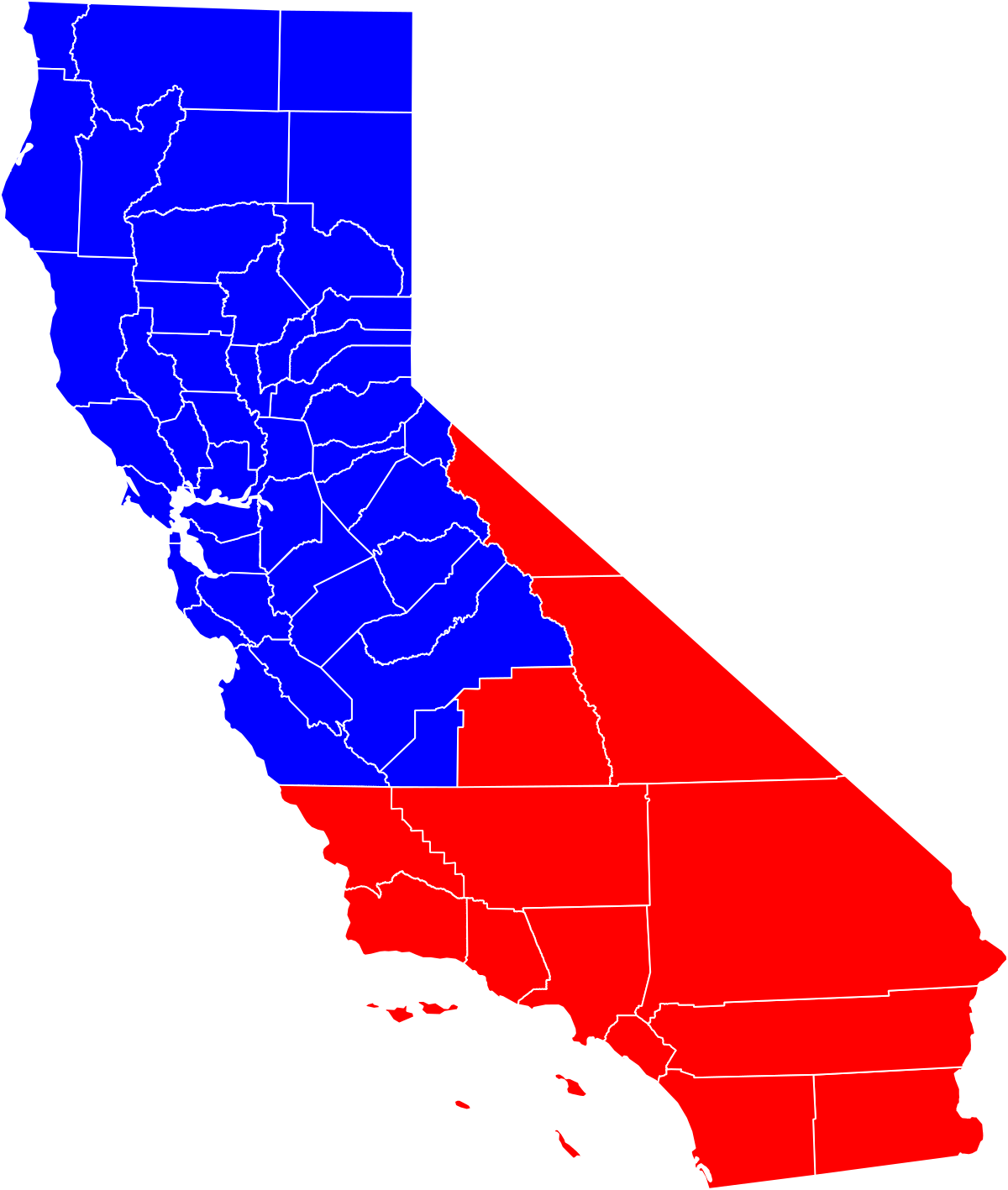

StateFarm is the largest auto insurance company in California and probably the biggest in the United States. Search for a health insurance plan by state plan name or plan type private Medicaid Medicare. Interinsurance Exchange of the Automobile Club serves AAA members in Southern California while the AAA Northern services AAA members in Northern California hence the name.

Founded in 2013 Oscar Health Plan of California is one of the only health insurance companies created in the new world of the Affordable Care Act. Health insurance companies are abundant and accessible in the Golden State. Like most other auto insurance companies Amica offers all of the required and beneficial elective coverages youd need.

The best home insurance companies in California protect your property from damages related to natural disasters but also provide flexible policies discounts online resources among other perks. The company had 144 market share in 2011. This way of rating plans emphasizes care outcomes the results of care people.

These companies offer individual and family plans in California. They believe health insurance should be simple smart and friendly.

Aaa Northern California Nevada Utah Wikipedia

Aaa Northern California Nevada Utah Wikipedia

The Best And Cheapest Home Insurance In California Valuepenguin

The Best Homeowners Insurance In California Quotewizard

The Best Homeowners Insurance In California Quotewizard

The Best Homeowners Insurance In California Quotewizard

The Best Homeowners Insurance In California Quotewizard

Top 10 Homeowners Insurance Companies

Top 10 Homeowners Insurance Companies

California Car Insurance Cheap Rates Free Tips

California Car Insurance Cheap Rates Free Tips

Auto Car Insurance List Of The Top Ten Car Insurance Companies In Usa

Auto Car Insurance List Of The Top Ten Car Insurance Companies In Usa

Top 10 Auto Insurance Companies In California

Where To Find Top Rated Auto Insurance Daydayloan

Where To Find Top Rated Auto Insurance Daydayloan

Best Auto Insurance Companies For 2021 Carinsurance Com

Best Auto Insurance Companies For 2021 Carinsurance Com

The Cheapest And Best California Car Insurance Companies 2021 Valuepenguin

Health Insurance Companies In California Covered California

Health Insurance Companies In California Covered California

Comments

Post a Comment