Featured

Is Medicare Plan G Better Than Plan N

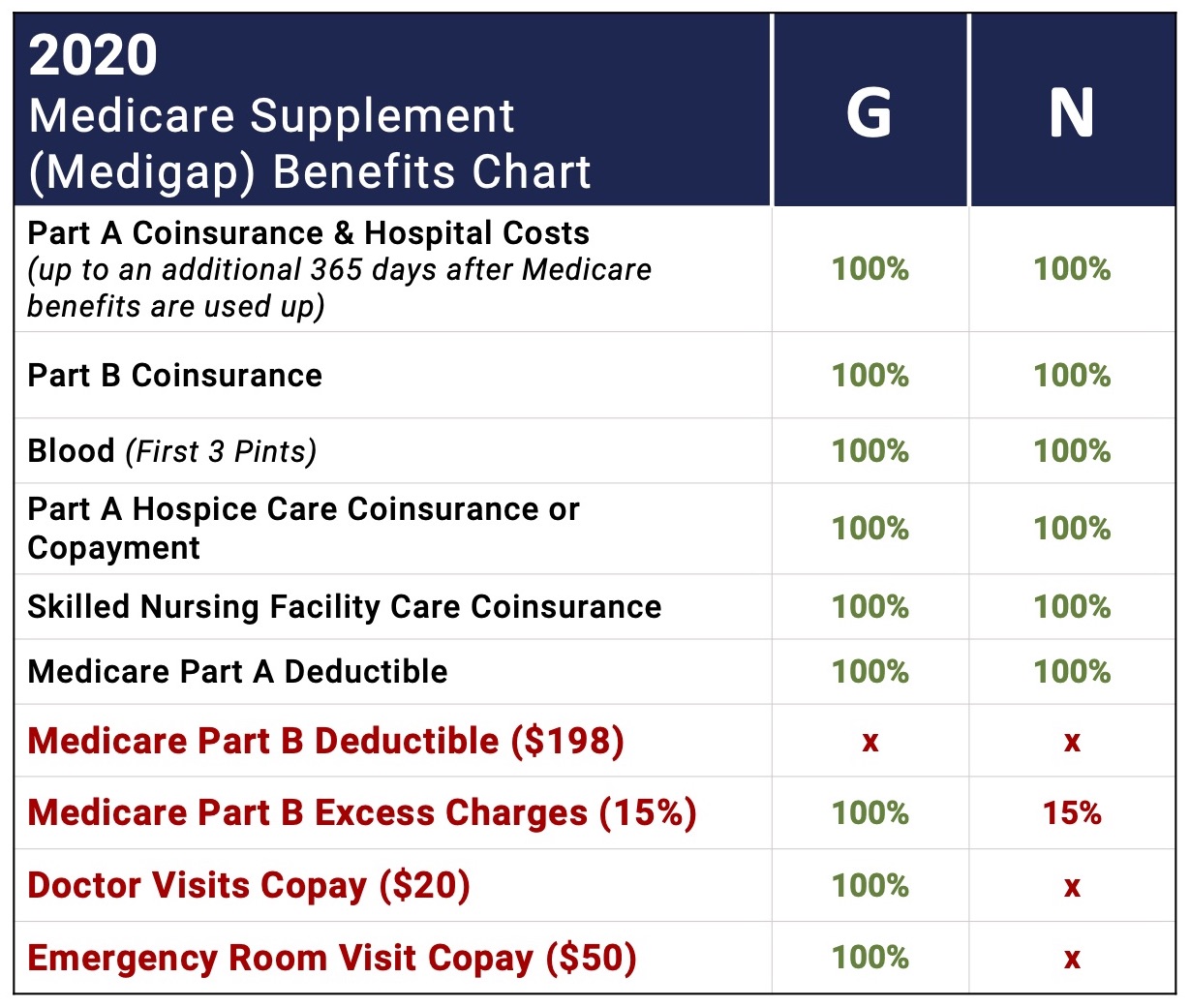

However it differs from Plan G by not covering Medicare Part B excess charges. Your choice is now easy because Plan G is the best plan you can buy.

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Is Medicare Plan N better than Plan G.

Is medicare plan g better than plan n. The reason G costs more is because it provides more coverage. Plan G is usually more expensive than Plan N. The Medigap Plan N policy has similar coverage as compared to Plan G.

If N is significantly cheaper than D then go for it. Is Medigap Plan G Better than Plan F Medicare Plan F vs Plan G - YouTube. Finally Plan N is probably the third most popular plan because it operates similar to Plan G except that you pay copays for doctor and ER.

If it is not less expensive than D is the better choice as it will save you from paying copays. For super healthy seniors with no family history of chronic illness later in life Medicare Plan N is the policy you should be comparing with Plan G. So Which is Better.

Is Medicare Plan G better than Plan F. Plan N offers the same coverage as Plan G in that it also does not cover the Medicare Part B deductible like Plan F does. However while Plan G usually has higher premiums it could save you money in the long run.

In this case Medicare Plan G is better than Plan F because F isnt available to you. Plan N is similar to plans F and G but it can be significantly less expensive. Since Plan G typically has a more expensive premium it actually may save you money in the long run.

As you can see Medigap Plan F and Plan G are very similar. As mentioned above you can incur Part B excess charges when your health care provider does not accept Medicare assignment. In plain English if you go with Plan N it should be slightly less expensive each month but you are subject to copays for office and emergency room visits.

The answer of course depends on the price. Medigap Plan G Premiums vs. For some people Plan N may be a cost-effective solution for Medigap coverage.

Plan G covers Part B excess charges which are not a concern in most cases but especially not if they arent allowed in your state to begin with. If they are only 10 less you should consider Medicare Supplement Plan F or G. If your Medicare Part N monthly premiums are 30-40 lower you may want to enroll in Plan N.

Plan D or Plan N. There are several points to consider when deciding which Medigap plan suits your need especially if you already have Plan F coverage. The next most comprehensive plan is Plan G which covers nearly as much with the Part B deductible being the only difference.

In addition some insurance companies are preparing for Medicare Supplement Plan D to be one of the top selling plans in Medicare. For instance if you go to the emergency room a few times throughout the year or if you need to visit your doctors office for treatment regularly your out-of-pocket costs with Plan N could easily add up and cost you more than. The standard Plan G has a higher monthly premium than the high deductible plan but has a substantially lower yearly deductible and a greater convenience of use.

Plan G is a better a value even for those that believe that they are limiting their out-of-pocket costs by enrolling in the Plan F because it has no deductibles or co-pays for any Medicare-approved healthcare. Plan F covers more than Plan G as it includes the Medicare Plan B deductible. However premiums for Plan G are usually higher than those for Plan.

This is especially true in states that have specific laws reducing the value of Medicare supplement Plan G. Plan F prices have also jumped substantially since the introduction of the act that discontinued their availability to new Medicare. However Plan N still provides a good amount of coverage and manages to minimize high out-of-pocket expenses.

Plan N also involves cost-sharing via copayments and coinsurance which Plan G covers. To be clear I am referring to the Medicare. Premiums for each plan can vary by the carrier that offers it but Plan G is typically more expensive than Plan N because it offers a higher level of coverage.

Depending upon the condition of your health it might be a better idea to sign up for Plan N even though there is a copay and may be 15 in excess charges associated with it. Medigap Plan N premiums cost less than Medigap Plan G thats because it offer lesser benefits. Medicare supplement Plan N can be a better value than Medicare supplement Plan G.

As a rule Medicare Plan N costs 25 less than Plan F. The standard Medicare Supplement Plan G with a low deductible rather than the High Deductible Plan G is usually be the better choice for most people choosing Plan G in my opinion. Visits and you also pay your own excess charges.

There is only one difference between the Plan F and Plan G. Medigap Plan N Premiums In most states Plan G generally runs about 20-25 more per month than Plan N More about Plan G prices.

Medigap Planners Medigap Plan G Or Medigap Plan N Compare Rates And Benefits Medigap Planners

Medigap Planners Medigap Plan G Or Medigap Plan N Compare Rates And Benefits Medigap Planners

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

Which Is Better Plan F Plan G Plan N Medicare Supplement Youtube

Which Is Better Plan F Plan G Plan N Medicare Supplement Youtube

Medicare Plan N Vs Plan G Senior Healthcare Direct

Medicare Plan N Vs Plan G Senior Healthcare Direct

Medigap Plan G Vs Plan N Medicare Hero

Medigap Plan G Vs Plan N Medicare Hero

Transamerica Medicare Supplement Plans For Baby Boomers

Transamerica Medicare Supplement Plans For Baby Boomers

Medicare Supplement Plan G Vs Plan N What Is The Difference Gomedigap

Medicare Supplement Plan G Vs Plan N What Is The Difference Gomedigap

Medicare Plan N Vs Plan G Which Is Better Freemedsuppquotes

Medicare Plan N Vs Plan G Which Is Better Freemedsuppquotes

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Plan N Medigap Plan N Medicare Supplement Plan N

Medicare Plan N Medigap Plan N Medicare Supplement Plan N

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Comments

Post a Comment