Featured

Covered California Income Chart 2019

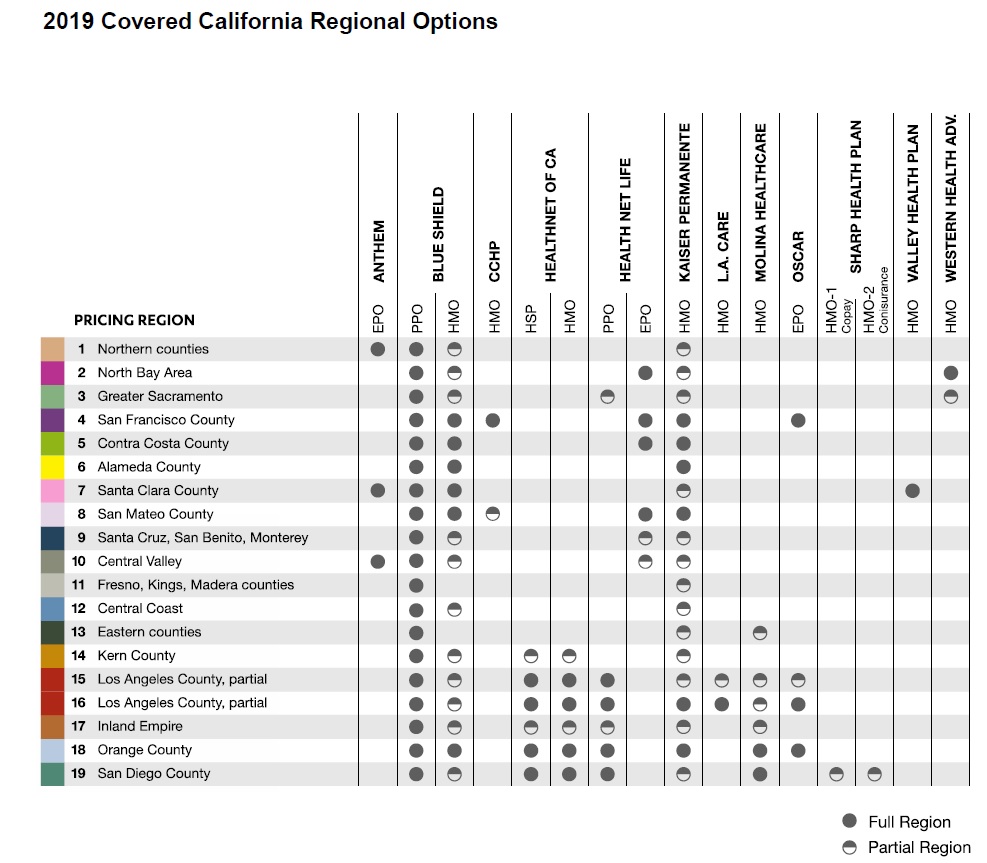

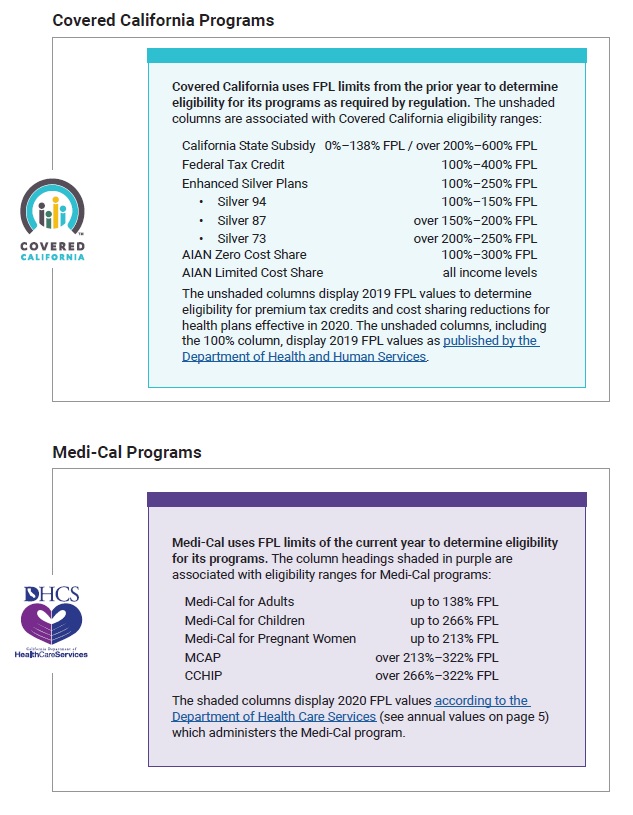

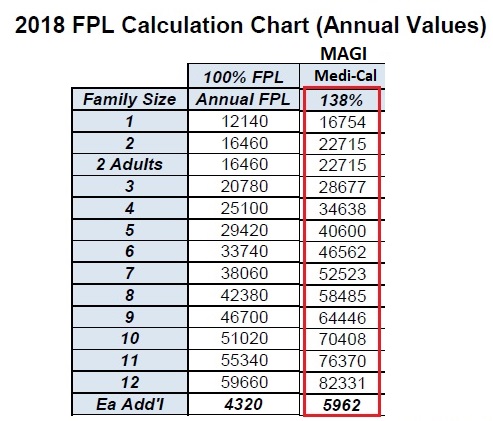

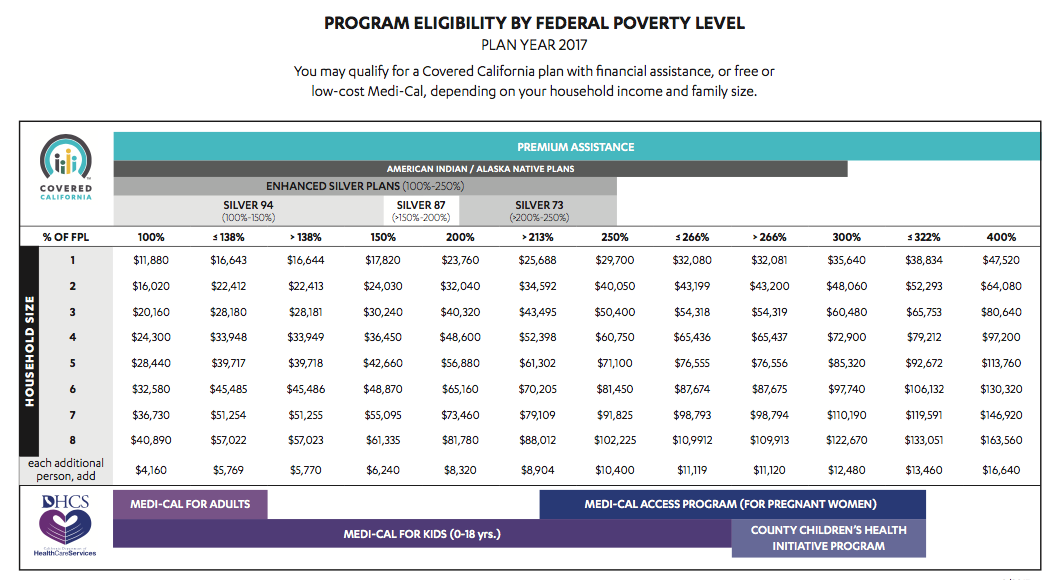

Depending on their income some consumers may qualify for the low-cost or no-cost Medi-Cal program. MAGI Medi -Cal.

Https Hbex Coveredca Com Toolkit Renewal Toolkit Downloads 2016 Income Guidelines Pdf

Most consumers up to 138 FPL will be eligible for Medi-Cal.

Covered california income chart 2019. Keep in mind that Tax deductions can lower your income level and may help you qualify for government. Protect Your Financial Stability. Covered California Health Plans Our health plans come in four metal tiers.

Ad Insure Your Salary Against Illness Or Injury. Most consumers up to 138 FPL will be eligible for Medi-Cal. Lower monthly premium if you.

If your MAGI is less than 138 of the FPL Federal Poverty Level you will have two Medi-Cal options being your first choice and un subsidized individual and family health insurance purchased directly from the. If ineligible for Medi-Cal consumers may qualify for a Covered California health plan with financial help including. The attached briefing materials detail Californias 2019 Income Limits and were updated based on.

Ad Insure Your Salary Against Illness Or Injury. They have different costs for premiums and services but the same great benefits. Varied Adaptable Cover To Suit You Your Familys Requirements.

In order to be eligible for assistance through Covered California you must meet an income requirement. If you make 601 of the FPL you will be ineligible for any subsidies. Federal tax credit California state subsidy Enhanced Silver plans and AIAN plans.

They will see their premiums for the benchmark plan lowered to 1 per member per month. View the chart in the next paragraph to find what you qualify for. Persons in Family Household.

Consumers at 400 FPL or higher may receive a. To also qualify for cost sharing reductions your family gross income must be more than 138 and less than 250 of the federal poverty level. Varied Adaptable Cover To Suit You Your Familys Requirements.

In January 2018 the Department of Health Care Services DHCS. It is overseen by a five-member board appointed by the governor and the Legislature. On the left are different types of income and deductions.

2021 Products By Zip Code. MAGI INCOME AND DEDUCTION TYPES Updated January 2019 Confused about what income to include. 2019 Federal Poverty Guidelines.

This web site is owned and operated by health for california which is solely responsible for its content. American Indian Alaska Native. Covered california income guidelines 2019 chart You will need to determine your familys MAGI Modified Adjusted Gross Income for the year.

Federal tax credit Silver 94 87 73 plans and AIAN plans. If ineligible for Medi-Cal consumers may qualify for a Covered California health plan with financial help including. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL.

Renewals for 2019 2019 Covered California Plan OE for 2019 SEPs in 2019 101 1215 11 1231 1015 115 1 1 1231 8 FEDERAL POVERTY LEVEL. This chart will help you check what income you need to include on your application. This site is not maintained by or affiliated with covered california and covered california bears no.

State of California Health and Human Services Agency. Covered california california health benefit exchange and the covered california logo are registered trademarks or service marks of covered california in the united states. California Department of Public Health.

Medi-Cal and Covered California have various programs with overlapping income limits. Then look under the columns MAGI MC or APTCCSR to. The chart applies the global weighted Covered California average increase of 87 percent to produce the estimated average unsubsidized premium which is an estimate of what off-exchange enrollees may pay in 2019 the actual 2019 amount will depend on enrollee take-up and plan choice during renewal and open enrollment.

Protect Your Financial Stability. 2021 Covered California Data. Find which income type you are wondering about.

To qualify for a subsidy from the government families must purchase their coverage through Covered California and have a gross income no more than 400 of the federal poverty level. An estimated 23000 Covered California enrollees whose annual household income falls below 138 percent of the federal poverty level FPL which is less than 17237 for an individual and 35535 for a family of four. When and where to apply for Covered California health insurance.

Covered California is an independent part of the state government whose job is to make the health insurance marketplace work f or Californias consumers. MEDICAL Each January the California Department of Health Care Services distributes income limits for its programs based on the most recently published federal guidelines of that same year. Lower monthly premium if you qualify for financial help.

2021 Open Enrollment Net Plan Selection Profile xlsx 2021 Open Enrollment Gross Plan Selection Profile xlsx 2020 Covered California Data. 1 changes to income limits the US. Department of Housing and Urban Development HUD released on April 24 2019 for its Public Housing Section 8 Section 202 and Section 811 programs and 2 adjustments HCD made based on State statutory provisions and its 2013 Hold Harmless HH Policy.

2021 Individual Product Prices for all Health Insurance Companies - UPDATED 9302020. AB 174 State Subsidy Report March 2020. The states open enrollment period is longer than the federal open enrollment period available to citizens in.

Medi-Cal and Covered California have various programs with overlapping income limits. For more information about Covered California.

C A L I F O R N I A M E D I C A L I N C O M E C H A R T Zonealarm Results

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

Https Hbex Coveredca Com Toolkit Webinars Briefings Downloads Fpl Webinar Slides Final Pdf

2019 Covered California Plan Booklet Of Rate Increases

2019 Covered California Plan Booklet Of Rate Increases

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

Covered California Income Tables Imk

Explaining Medi Cal Covered California Federal Poverty Level Income Amounts

Explaining Medi Cal Covered California Federal Poverty Level Income Amounts

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Covered California Health Insurance Income Guidelines

How Do I Know If I Qualify For Covered California Or Medi Cal

How Do I Know If I Qualify For Covered California Or Medi Cal

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Comments

Post a Comment