Featured

Is Medicare Plan F The Best

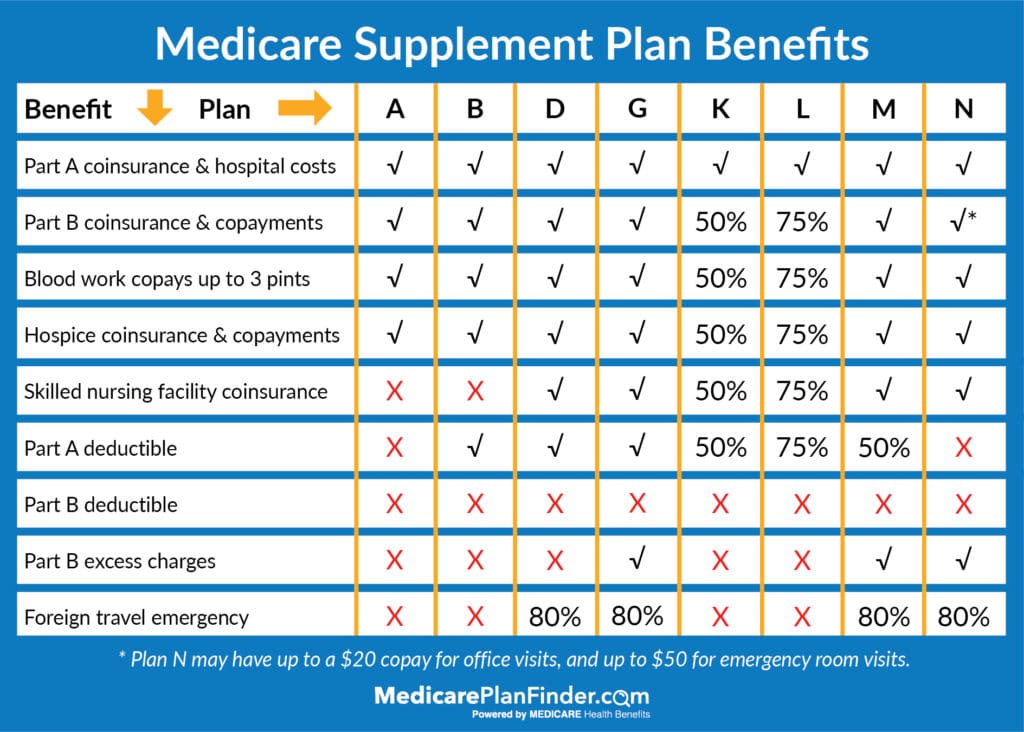

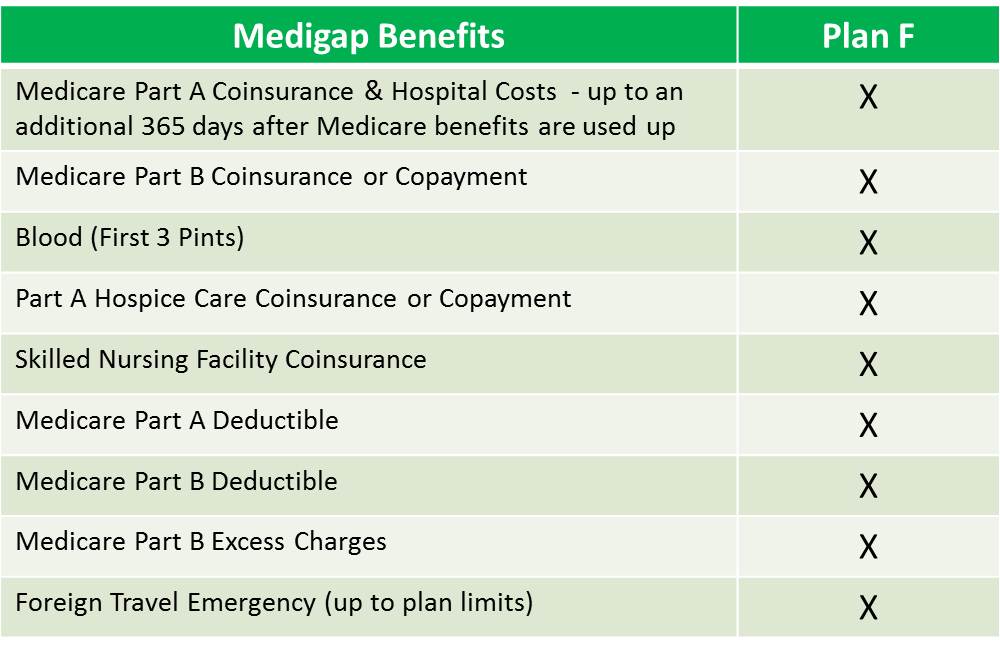

Medicare Supplement G Plans have stepped up as the leader in having the lowest out-of-pocket costs covering everything F plans do with the exception of the Part B deductible 198 in 2020. Plan F has been called the Cadillac of Medigap plans providing first-dollar coverage.

Medicare Plan G Review Medicare Nationwide

Medicare Plan G Review Medicare Nationwide

If youre looking to.

Is medicare plan f the best. If you didnt become eligible for Medicare until 2020 or later Plan F wont be available to you. Read our reviews best tips and more for the best medicare quote available. Many insurance companies offer Medicare supplement plans.

After exhaustive research we determined that the following companies offer the best Medicare supplement plans of 2021. Weve given Humana our No. You can start by reading our Medicare Supplement Plan F Reviews here.

As a result Medicare Supplement Plan F is by far the most popular Medigap Plan used by seniors in the United States. Because it offers the most benefits Plan F premiums are generally the most expensive. This is the best Medicare Part D plan option for seniors as it mixes low co-pays with competitive premiums and has a network of preferred providers.

AARP Medicare Rx with services provided by United Healthcare is an excellent all-round provider of Medicare Part D plans and is the only range of plans backed by AARP. This means that if you decide Plan F is the best Medigap plan for you when you shop for a Medigap plan its important to consider the plan cost and the insurance companys reputation. With this plan you pay no out-of-pocket costs for your medical needs.

Medicare Supplement Plan G is one of the most popular supplement plans. If you currently have Medicare Supplement Plan F you can switch to high-deductible Plan F by contacting. To help you find the best Medicare Supplement Plan G provider we compared and.

A UHC Plan F will provide great benefits but ALL Medicare supplement Plan F policies give you the exact same benefits and doctor access. You pay for Medicare-covered costs up to the 2340 2370 in 2021 before the plan begins to pay for anything. Close to 34 percent of all Medicare beneficiaries are enrolled in a Medicare supplement insurance Medigap plan.

While the Medigap Plan F coverage is comprehensive price wise Plan F is not always the best value. Only those that serviced 40 or more states were considered. If youre looking for the most coverage possible at a very affordable price tag Plan F is the best Medicare supplement plan.

If you choose Plan F youll essentially only pay your monthly premium and have no out-of-pocket costs for your covered medical expenses. We chose it primarily. Do your research before you enroll and later find out you are paying 300 more per year than you needed to.

If you were eligible for Medicare before January 1 2020 you may still enroll in Plan F. In fact a survey conducted in 2010 showed that 40 of all Medigap Plans held were Plan F. These optional plans issued by private insurance companies help pay for some of the out-of-pocket costs that Original Medicare Part A and Part B doesnt cover.

High-deductible Plan F. Medicare Plan F vs. Humana went from owning and operating.

Plan F covers more out-of-pocket Medicare costs than any other Medigap plan. Most striking is one company in North Carolina that offers a Plan F with an annual premium of 3556. Medigap Plan F is the costliest supplement policy available but for many Medicare enrollees the future savings make the monthly premium worthwhile.

Choose from our list of the 5 best medicare advantage plans in 2021. Humana is one of the largest providers of healthcare and healthcare insurance in the country. Humana is one of the largest Medicare insurers in the country.

With Plan F being phased out Plan G may be the best plan for you. Only Plan G comes close to offering nearly as much coverage as Plan F. Plan G Plan F offers the most comprehensive Medigap coverage available so its not a surprise that its the most popular plan nationwide.

Plan F has long been the most popular Medigap plan. The high-deductible version of Medicare Plan F has a lower monthly premium and higher out-of-pocket expenses. Each company was ranked based on the quality and ease of use of its website price transparency whether prices were based on age and the types of plan.

2 ranking because they offer Medigap plans A-N have. Click here to learn more. If you want Medicare information broken down clearly and in a straightforward manner Blue Cross Blue Shield BCBS is the best company to go through for Medicare Advantage.

The plan pays the first dollar of the first medical bill and the beneficiary never writes a. To find the top Medicare Supplement carriers we reviewed all companies in the Medigap Find a Plan database that offered Plan F and High-Deductible Plan F. In Washington a Plan Fs premium is 2568 and the Plan G1896 a difference of 672.

Lately however Plan G has been giving F a run for its moneyespecially since Plan F is no longer available to newly eligible Medicare recipients.

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Act Now Don T Lose Coverage With Medicare Plan F Going Away

Act Now Don T Lose Coverage With Medicare Plan F Going Away

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

Best Medicare Supplement Plan F Rates Benefits Medigap Plan F Comparison

Best Medicare Supplement Plan F Rates Benefits Medigap Plan F Comparison

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medigap Plan F Medicare Supplement Plan F Medicarefaq

Medigap Plan F Medicare Supplement Plan F Medicarefaq

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medicare Supplement Plan F 7 Essential Facts You Must Know Clear Medicare Solutions

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Comments

Post a Comment