Featured

Medicare Advantage Part B

You can find out if you have Part B by looking at your Medicare card. Part C plans can include a range of additional items not covered under Original Medicare benefits such as transportation to the doctor over-the-counter drugs vision and dental care and gym.

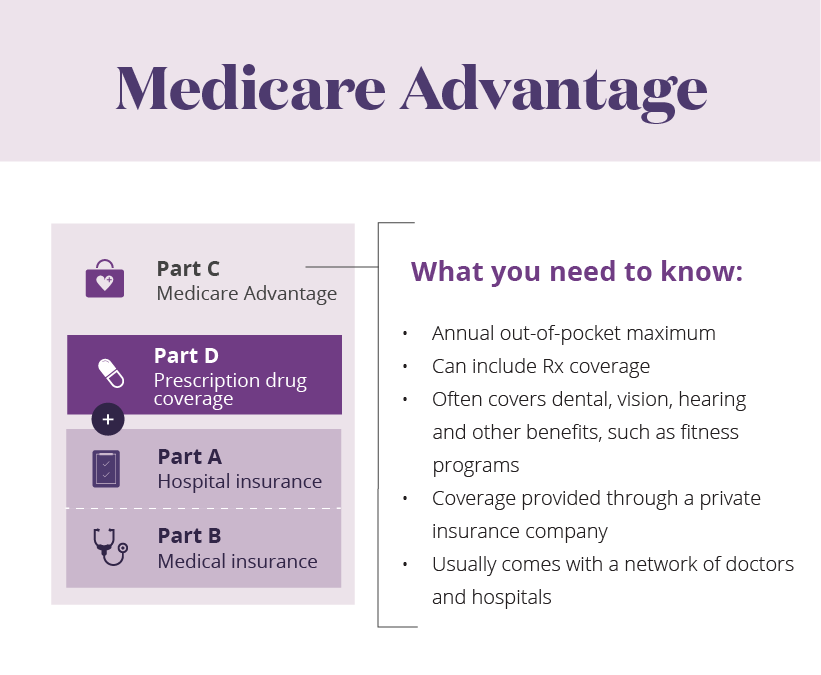

Medicare Benefits Parts A B C And D Medical Mutual Of Ohio

Medicare Benefits Parts A B C And D Medical Mutual Of Ohio

Most Medicare Advantage Plans include drug coverage Part D.

Medicare advantage part b. Once you meet this deductible Medicare will typically pay 80 of the Medicare-approved amount for. 2 ways to find out if Medicare covers what you need. Usually you must pay 20 of the Medicare-approved amount for a service.

Original Medicare sometimes referred to as traditional Medicare is. Medicare Part B also has a deductible that you must meet before coverage begins. Durable medical equipment DME Mental health Inpatient.

This is called your coinsurance. Some people qualify for automatic enrollment and others have to enroll. Most people have this premium taken directly out of their Social Security check each month.

Part B is medical insurance and covers certain outpatient care such as doctors office visits preventive care medical equipment and other qualified services. Some Medicare Advantage plans have a 0 monthly premium while others come with a higher monthly premium. If you need a service that the plan says isnt medically necessary you may have to pay all the costs of the service.

In addition to your Part B premium you usually pay a monthly premium for the Medicare Advantage Plan. In 2021 the standard Part B premium amount is 14850 or higher depending on your income. Medicare Advantage is a one-stop-shopping program that combines Part A and Part B into one plan.

Part B covers things like. In addition about 90 percent of MA plans also include prescription drugs which means you wouldnt have to enroll in a separate Part D plan. Medicare Part B helps cover medically necessary services like doctors services outpatient care home health services and other medical services.

Medicare Part B covers medical insurance benefits and includes monthly premiums an annual deductible coinsurance and other potential costs. There are no Medigap policies for Advantage plans. 2021 Part B premiums The standard monthly premium for Medicare Part B is 14850 per month in 2021.

In 2021 the standard monthly Part B premium cost is 14850. Limited outpatient prescription drugs. You pay a premium monthly payment for Part B.

Medicare Advantage Plans are another way to get your Medicare Part A and Part B coverage. Clinical research Ambulance services. Signing up for Original Medicare.

Medicare Advantage plans are offered through private insurance companies and. In 2021 the standard Part B premium is 14850 per month but not everyone pays the same Part B costs. Medicare Part B is optional for all beneficiaries.

Original Medicare Medicare Advantage For Part B-covered services you usually pay 20 of the Medicare-approved amount after you meet your deductible. Part B will not cover anything until you pay that amount each year that you use the coverage. All plans have a Medicare Part B premium since they offer Original Medicare coverage though many plans have additional coverage on top of that.

If you join a Medicare Advantage Plan you still have Medicare. You may not know that Original Medicare Part A and Part B has no out-of-pocket maximum. Talk to your doctor or other health care provider about why you need certain services or supplies.

Part B covers the other 80. In addition to the annual deductible you must pay for a portion of the services covered by Part B. If you choose to join a Medicare.

Some Medicare Advantage plans have premiums as low as 0. Medicare Advantage plans also known as Medicare Part C became an option for Medicare beneficiaries to purchase from private healthcare insurance companies in 1997. Find Medicare Advantage Plans in your area.

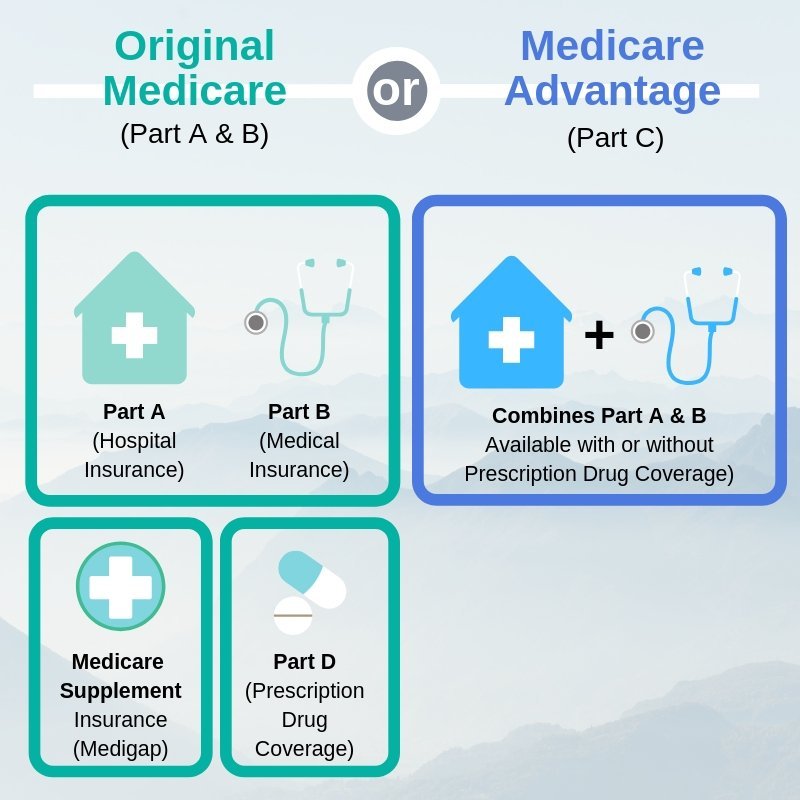

Medicare Advantage Part C is an insurance option for people who are already enrolled in Medicare Part A and Part B. Medicare Advantage Plans sometimes called Part C or MA Plans are offered by Medicare-approved private companies that must follow rules set by Medicare. Some Medicare beneficiaries may pay more or less per month for their Part B coverage.

These bundled plans include Medicare Part A Hospital Insurance and Medicare Part B Medical Insurance and usually Medicare drug coverage Part D. Medicare Advantage plans must provide the same coverage as Parts A and B but many offer additional benefits such as vision and dental care hearing exams wellness programs and Part. Part B also covers some preventive services.

Medicare Advantage plans are known for bundling Part A and Part B benefits along with additional benefits such as Part D prescription drug coverage. Out-of-pocket costs vary plans may have lower out-of-pocket costs for certain services. Medicare Advantage plans Part C.

Medicare Parts A B C and D Original Medicare Part A and Part B. Regardless if the Medicare Advantage plan you choose has a monthly premium or not you must continue to pay your Medicare Part B premium. Out of pocket maximum.

You must continue to pay your Part B premium which is 14460 per month for most. They are offered by private companies approved by Medicare. In 2021 the Medicare Part B deductible is 203.

The Disadvantages Of Medicare Advantage The Culpeper

The Disadvantages Of Medicare Advantage The Culpeper

What Is Medicare Advantage Physicians Medical Group Of San Jose

What Is Medicare Advantage Physicians Medical Group Of San Jose

What Is Medicare Western Connecticut Area Agency On Aging

Medicare Advantage Vs Medicare Supplement Ixsolutions

Medicare Advantage Vs Medicare Supplement Ixsolutions

Medicare Advantage Insurance Agency For Seniors

Medicare Advantage Insurance Agency For Seniors

Learn About The Parts Of Medicare Aetna Medicare

Learn About The Parts Of Medicare Aetna Medicare

Medicare Advantage Understanding Eligibility Coverage More Intermountain Healthcare

Medicare Advantage Understanding Eligibility Coverage More Intermountain Healthcare

Medicare Advantage Plans In Oregon Health Plans In Oregon

Medicare Advantage Plans In Oregon Health Plans In Oregon

Comments

Post a Comment